Important Information on the Massachusetts Clean Heat Standard

To all our valued customers,

By now you are aware that MassDEP has been formulating a Clean Heat Standard that certainly will affect you in one way or another. We have some updates on the CHS that we want to share with you. This past November, MassDEP released draft framework of the CHS. In December we participated in stakeholder meetings with MassDEP where they presented their thoughts on the draft framework. Much of what is in the draft framework is what we initially reviewed and have been presenting to you over these past several months, but of course there were surprises in the final draft. So, what are the highlights?

- The obligated parties in this standard are ALL heating oil, propane, natural gas AND ELECTRICITY.

- There are TWO standards within the Clean Heat Standard: An Emissions Reduction Standard AND a Full Electrification Standard.

- The Emissions Reduction Standard is essentially what we expected. We (energy suppliers) must lower our emissions output year after year. We do this by either blending biodiesel into our fuel (as we already do), selling less fuel (AKA firing customers), or by paying a large fine (which MassDEP conveniently calls “purchasing credits”).

- The Full Electrification Standard is the problematic (costly) one. I mentioned in my first letter to you that the goal of MassDEP was to convert every home in the Commonwealth to electric heat. I took some heat (no pun intended) from some of our customers who claimed I was fearmongering this subject. Well, my proof lies in this draft framework. EVERY oil, propane, natural gas and electric supplier IS REQUIRED to convert an escalating percentage of their customer base to electric heat pump OR PAY an astronomical fine (which again they call “purchasing credits”).

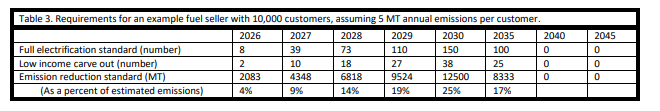

- So how much is the Full Electrification Standard Fine? I cut and paste below the exact example given to us in the MassDEP draft framework. The draft framework sets the fine (“purchasing credit” value) of each full home electrification at $6,000 in 2026, increasing $1000 each year to $10,000 in 2030, and will remain at $10,000 per household annually after that. The low-income household carveout is DOUBLE THAT AMOUNT! (25% of full electrification projects completed or credits purchased each year are REQUIRED to come from low-income households.)

Using the example MassDEP has provided, in 2030 this example company would have to pay an $1,880,000 fine just on the full electrification standard side of the CHS. This DOES NOT include the emissions reduction standard fine. This means a $188 increase in heating costs per customer in 2030 for just ½ of the Clean Heat Standard obligations.

- 112 full electrification house obligation = 112 x $10,000 = $1,120,000

- 38 Low-income house obligation = 38 x $20,000 = $760,000

- $1,120,000 + $760,000 = $1,880,000 fine.

- $1,880,000 divided by 10,000 customers = $188 per customer “tax”.

These numbers are if an energy supplier doesn’t capitulate to MassDEP demands. I can tell you I am not going to voluntarily fire any one of our customers, nor can I force you to spend $20,000 or so on a heat pump conversion. Nor can MassDEP force anyone to convert, even though that is exactly what they are attempting to do! They are just going to “tax” you until YOU DO capitulate. Of course, as I have previously mentioned, nowhere in the CHS program is this called a tax, even though the entire program really is a carbon tax.

Back to the Emissions Reduction Standard. How much will that cost you? Well again referring to the MassDEP example THEY PROVIDED, we can calculate as follows…

- 12,500 MT (the compliance obligation for a 10,000-customer company in 2030) x $190 (the emission reduction standard price cap / ACP per MT) = $2,375,00 fine in 2030 from the emission reduction standard.

- $2,375,000 fine divided by 10,000 customers = $237.50 per customer “tax”.

THIS MEANS WE CAN EXPECT IN 2030, that each customer will have to pay $425.50 MORE TO HEAT THEIR HOME. JUST for that year!

We should be able to mitigate some of the Emissions Reduction Standard penalty by blending biodiesel. But there is no way to guarantee that. We CAN essentially guarantee you one thing: if the CHS does come to fruition as is stated in the draft framework, the cost of biodiesel will go up (all renewables actually), so whatever savings we might be able to pass on will most likely be moot.

- There is one more important note to the Emissions Reduction Standard: Although MassDEP will allow us to lower our emissions output by blending biodiesel with our ultra-low sulfur heating oil, they are not including RENEWABLE propane in the standard. In other words, propane is just getting “taxed” even though propane as it exists currently has the lowest carbon output of all fuels.

- Regardless of how you heat your home… YOUR COSTS ARE GOING UP UNDER THE CHS! Not only is your oil bill(s) going to go up, but your electricity bills are also going up as well. As a matter of fact, the draft regulation stipulates that in 2040 the entire CHS obligation falls on the electric companies. You might have a heat pump now… BUT YOU WILL STILL PAY MORE!

Clean Heat Standard Q&A

Q: Why is MassDEP implementing a CHS?

A: This regulation is a result of a Massachusetts law passed in August 2008 called the Global Warming Solutions Act. Regulations such as this is what happens when politicians pass laws that require specific outcomes, yet they have no idea how to implement anything to achieve said outcomes.

Q: How much is my price per gallon of oil going to go up?

A: MassDEP hasn’t given us all the metrics yet and I doubt we will see them before a final regulation is produced. Based on what I can extrapolate from the draft framework, I estimate in 2030 the price per gallon “tax” on heating oil will be around 75 cents per gallon.

Q: Where can I look up information on the CHS?

A: MassDEP keeps a webpage on all things CHS. You can see every document I can at this link here! I ENCOURAGE EVERYONE to visit this page and read all the information provided, especially the draft regulation itself.

Q: What can I do to help stop a CHS from becoming a reality?

A: The only person(s) that can put a stop to MassDEP implementing this is the Commonwealth of Massachusetts Legislature. They are the only ones with the power to undo or modify laws which have already been passed. Last summer, I started a CHS campaign asking all our customers to contact their state representatives on this matter. Many of you have and I thank you! If you have yet to contact your representative, we have an easy-to-use form to do this located on our website. In addition, feel free to contact MassDEP directly to voice your displeasure.

CONTACT YOUR STATE REPSIn Conclusion

We believe that a clean climate should be everyone’s goal, from corporations and retail businesses to energy suppliers and consumers. Heating oil and propane are no exceptions to this rule, and we have been delivering those since 2004. Ultra-low sulfur heating oil, Bioheat® fuel, and renewable diesel have reduced carbon emissions by over 50% from the 1990s and will do even better as we reach our goal of 100% renewable by 2050. All this has happened without you spending thousands of dollars to change the heating system in your home. No single agency should have the power to eliminate a consumer’s choice, especially without legislative approval and there should NEVER be a single source of energy in America.

We at FSi have been strong stewards of the environment since we started selling biodiesel in 2004, and we will continue that movement. However, we believe that it should be done in a logical manner, following a planned path to get us there with the proper infrastructure in place and with sensible alternatives. There are only a handful of oil, propane, natural gas and electricity suppliers in Massachusetts, and we can’t fight this alone. But there are almost 7 million residents in Massachusetts who have the power to tell the MA legislature that they don’t want MassDEP dictating how they can heat their home, cook their food, heat their water, use their fireplaces, or run their generators and tax them because they do. We are doing what we can, but we can’t do it alone.

Sincerely,

Stephan C Chase

President

CONTACT YOUR REPRESENTATIVES